What the Realtor lawsuit verdict means for home buyers

The way agents are paid will probably change. And that could mean lower prices for buyers.

A lawsuit in the real estate industry might actually end up being good news for home buyers. Axios reported a Missouri jury this week found the National Association of Realtors had conspired with brokerages to inflate commissions on home sales. The decision "puts the defendants on the hook for $1.8 billion" in damages. While the decision will be appealed, "these fees are going to start dropping now." How low? "A seller's fee could be as low as zero." And that could bring home prices down.

"It's a decision that has the potential to rewrite the entire structure of the real estate industry in the United States," The New York Times reported. Under the NAR rules, home sellers have been required to pay commissions to the buyer's agent. The seller of a $1 million home can pay as much as $60,000 in agent fees as a result. If the verdict holds, though, "sellers would no longer be required to pay their buyers' agents."

That change would be an "earthquake" in the real estate industry, Lance Lambert wrote at ResiClub, a news and research firm that analyzes the housing market. And more lawsuits against the real estate industry could be in the offing. "The big outstanding question here is if today was a small quake, or this first tremor in something much much bigger."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

'Nearly invisible to buyers'

In the United States, home sales usually involve an agent each for both the buyer and seller. "The seller pays the commission to both of them," Rachel Kurzius explained at The Washington Post. If a seller tries to opt out of paying the buyer's agent, the house won't be listed on multiple listing sites (MLS) like Zillow or Redfin. And a home that can't be listed on Zillow "becomes nearly invisible to potential buyers." But those same sites have made real estate information so accessible that most buyers don't need an agent to find a house. "Yet commissions have not changed to reflect that."

One possible change to the system "is that buyers would pay their own agents but could negotiate for the seller to help cover that cost as part of the deal," The Wall Street Journal reported. Buyers could benefit in weak housing markets by getting sellers to cover the whole cost; sellers in tight markets would have leverage to charge a little more. One expert said that process would let market forces "make sure you've got a correlation between service provided and the commission that the broker is getting."

Some observers believe any changes will affect home prices only at the margins. The current tight supply of housing "will keep prices high," Marketplace reported. And the verdict could threaten the future of those MLS websites, making the market a bit less transparent than it is now. "The buyer would need to go to several different services to get a sense of what's in the market as a whole," said Susan Wachter, a professor at the Wharton School of Business.

'Paying less money'

Indeed, Yahoo reported that Zillow's shares dropped 7% in the immediate aftermath of the Missouri verdict. The company doesn't rely directly on commission income, but "its core business is selling marketing services to buyers' agents."

Back in Missouri, there is still more work to be done in court. The Associated Press reported that the core $1.8 billion in damages could be "trebled," putting the ultimate penalty on the defendants at more than $5 billion. For most home buyers, the lawsuit's importance will be the changes to the housing market: As housing prices have soared, so have agent commissions, which in turn have added to the price of a sale. "If sellers no longer had to pay the buyer agents, there wouldn't be that inflation and buyers could negotiate the commission down and they would end up paying less money," said Stephen Brobeck at the Consumer Federation of America. That could take some time to play out, a spokesman for the Realtors said. "This matter is not close to being final as we will appeal the jury's verdict."

Continue reading for free

We hope you're enjoying The Week's refreshingly open-minded journalism.

Subscribed to The Week? Register your account with the same email as your subscription.

Sign up to our 10 Things You Need to Know Today newsletter

A free daily digest of the biggest news stories of the day - and the best features from our website

Joel Mathis is a freelance writer who has spent nine years as a syndicated columnist, co-writing the RedBlueAmerica column as the liberal half of a point-counterpoint duo. His work also regularly appears in National Geographic, The Kansas City Star and Heatmap News. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

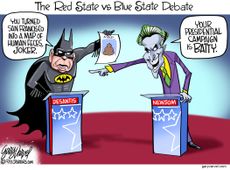

Today's political cartoons - December 2, 2023

Today's political cartoons - December 2, 2023Cartoons Saturday's cartoons - governors go Gotham, A.I. goes to the office party, and more

By The Week US Published

-

10 things you need to know today: December 2, 2023

10 things you need to know today: December 2, 2023Daily Briefing Death toll climbs in Gaza as airstrikes intensify, George Santos expelled from the House of Representatives, and more

By Justin Klawans, The Week US Published

-

5 hilarious cartoons about the George Santos expulsion vote

5 hilarious cartoons about the George Santos expulsion voteCartoons Artists take on Santa versus Santos, his X account, and more

By The Week US Published

-

2023: the year of labor strikes

2023: the year of labor strikesThe Explainer Workers from Hollywood to the auto lines walked off the job this year

By Justin Klawans, The Week US Published

-

The daily business briefing: December 1, 2023

The daily business briefing: December 1, 2023Business Briefing Tesla starts Cybertruck deliveries, the Dow surges to end November at a 2023 high, and more

By Harold Maass, The Week US Published

-

Elon Musk overshadows his own Cybertruck rollout

Elon Musk overshadows his own Cybertruck rolloutTalking Point The X owner's latest bizarre public appearance and incendiary comments threaten to derail the 'biggest product launch of anything by far on Earth this year'

By Rafi Schwartz, The Week US Published

-

The daily business briefing: November 30, 2023

The daily business briefing: November 30, 2023Business Briefing The UAW pushes to unionize non-union automakers, Disney's Bob Iger says he's 'definitely' leaving in 2026, and more

By Harold Maass, The Week US Published

-

The daily business briefing: November 29, 2023

The daily business briefing: November 29, 2023Business Briefing Mark Cuban reportedly agrees to sell majority stake in Dallas Mavericks, Charles Munger dies at age 99, and more

By Harold Maass, The Week US Published

-

The daily business briefing: November 28, 2023

The daily business briefing: November 28, 2023Business Briefing Holiday shopping starts with strong online sales, X loses more advertisers, and more

By Harold Maass, The Week US Published

-

The daily business briefing: November 27, 2023

The daily business briefing: November 27, 2023Business Briefing Holiday shopping starts with strong online sales, X loses more advertisers, and more

By Harold Maass, The Week US Published

-

Consumers shatter record for Black Friday online shopping

Consumers shatter record for Black Friday online shoppingSpeed Read Americans spent an estimated $9.8 billion online during Black Friday sales, according to reports

By Justin Klawans, The Week US Published