Gazundering: the trend shaking up the property market

More buyers are reducing their offers at the last minute to force cheaper sales

One in three house sellers are falling victim to a frustrating property market trend: "gazundering".

In the past six months, 31% of vendors have been gazundered, which is when a buyer reduces their accepted offer just before contracts are signed and exchanged, according to research by House Buyer Bureau.

In some dialects, a "gazunder" was a potty that "goes under" the bed, explained The Guardian, but it "has a different meaning now, and this one is far worse".

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It is "the opposite of gazumping", said FT Adviser, "which becomes more frequent when the market favours the seller".

Gazundering has seen a 97% increase in internet search interest since the start of the year, said estate agent comparison website GetAgent.co.uk, noting that cooling house prices mean the power is now "very much in the hands of the nation's homebuyers".

Why does gazundering happen?

Gazumping, where someone puts in a higher bid for a property that is already under offer to another buyer, "used to be quite common" and is in some ways a "sign of a successful economy", said The Guardian.

Now it is a "buyer's market" with less competition, and so sellers have little choice when their purchaser drastically reduces their offer at the last minute.

House prices unexpectedly increased in October, but overall home values have been "hurt" in 2023, said Sky News business reporter James Sillars. This is due to the "impact of the continuing cost of living crisis and surge in borrowing costs", imposed by the Bank of England to tackle inflation. According to RightMove, the average two-year fixed term, 95% loan-to-value mortgage rate is now 6.22%. Rates are expected to remain high until summer 2024.

House prices hit a 150-year-high last year, with the average house costing around nine times the average salary. This looks set to change. Zoopla predicts that, in 2024, house prices will fall by 2%, partly driven by high mortgage rates, but also because the number of homes for sale is at a five-year high.

Securing a buyer is therefore "a task in itself", Chris Hodgkinson, managing director of House Buyer Bureau, told Metro. As a gazundered seller, "there's really nothing you can do other than to accept the lower offer, or pull out of the sale completely".

How can a seller avoid being gazundered?

HomeOwners Alliance recommends setting a fair price to begin with, and being transparent about any issues so that offers are realistic. And where possible, favour chain-free buyers who can move quickly.

Although estate agents and solicitors prefer the buyer and seller not to contact each other, building a relationship is a good way to ensure against underhand dealings.

Sellers can also keep their houses on the market and continue to accept viewings until contracts are signed, advises Property Investments UK.

Ultimately, "there is something seriously wrong with the way that we buy and sell houses", wrote The Sunday Times money editor Johanna Noble last December. Legislation is needed, he said. Valuing a property amounts to "pretty much guesswork", and having an offer accepted "is no guarantee" of a sale. "It’s like the Wild West out there."

Continue reading for free

We hope you're enjoying The Week's refreshingly open-minded journalism.

Subscribed to The Week? Register your account with the same email as your subscription.

Sign up to our 10 Things You Need to Know Today newsletter

A free daily digest of the biggest news stories of the day - and the best features from our website

-

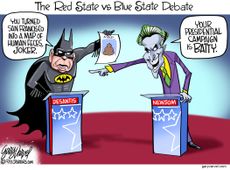

Today's political cartoons - December 2, 2023

Today's political cartoons - December 2, 2023Cartoons Saturday's cartoons - governors go Gotham, A.I. goes to the office party, and more

By The Week US Published

-

10 things you need to know today: December 2, 2023

10 things you need to know today: December 2, 2023Daily Briefing Death toll climbs in Gaza as airstrikes intensify, George Santos expelled from the House of Representatives, and more

By Justin Klawans, The Week US Published

-

5 hilarious cartoons about the George Santos expulsion vote

5 hilarious cartoons about the George Santos expulsion voteCartoons Artists take on Santa versus Santos, his X account, and more

By The Week US Published

-

The 'Scream' calamity: how a beloved film series collapsed

The 'Scream' calamity: how a beloved film series collapsedUnder the Radar Why the long-running franchise may not recover after losing its leading ladies

By Brendan Morrow, The Week US Published

-

Properties of the week: stunning houses for winter sun

Properties of the week: stunning houses for winter sunThe Week Recommends Featuring a beachfront cottage in Grand Cayman and a villa in Costa Rica with sea and jungle views

By The Week UK Last updated

-

6 welcoming homes great for family gatherings

6 welcoming homes great for family gatheringsFeature Featuring a home with 13 fireplaces in Maine and a home with heated brick floors in New Mexico

By The Week US Published

-

Why does Warner Bros. keep canceling finished movies?

Why does Warner Bros. keep canceling finished movies?Under the Radar The studio's decision to scrap multiple completed films isn't sitting well with Hollywood

By Brendan Morrow, The Week US Published

-

Properties of the week: splendid houses in Wales

Properties of the week: splendid houses in WalesThe Week Recommends Featuring Georgian-style homes and a delightful cottage with direct access to a secluded beach

By The Week UK Published

-

6 spacious homes for equestrians

6 spacious homes for equestriansFeature Featuring an indoor riding arena in Washington and an 11-stall barn in New Hampshire

By The Week Staff Published

-

Properties of the week: idyllic retreats for less than £700,000

Properties of the week: idyllic retreats for less than £700,000The Week Recommends Featuring a gorgeous thatched cottage in Wiltshire and a New England-style house close to the beach on the Isle of Wight

By The Week UK Published

-

6 captivating homes for stargazers

6 captivating homes for stargazersFeature Featuring a tropical garden with fruit trees in Hawaii and a wraparound deck in Maine

By The Week Staff Published