Don’t count on working forever

And more of the week's best financial insight

Here are three of the week's top pieces of financial insight, gathered from around the web:

Don’t count on working forever

Don’t base your retirement savings strategy on a plan to work longer, said Greg Iacurci at CNBC. In 2022, the average expected retirement age was 66, meaning that’s when people thought they would retire. But, due most likely to unforeseen circumstances, "the average actual retirement age was 62." We’ve all heard that "delaying retirement by just a few years can have a 'dramatic' positive financial effect." But late retirement is not a certainty you can count on. Two-thirds of people who said they retired early in 2023 did so "because of a hardship like a health problem or disability," or because of changes at their company. Only about 35% said they "could afford to retire early." So it’s important to save as if retirement could come sooner rather than later.

Gen Z brings its politics to the office

Talking politics at the watercooler is no longer the taboo it once was, said Jo Constantz in Bloomberg. About 3 in 5 U.S. workers said they have discussed politics with co-workers over the past year, according to Glassdoor. Interestingly, this shift in workplace decorum is being driven not by older workers but by the younger generation, who appear to be "the most outspoken about their beliefs and are most likely to want to work with colleagues and leaders that share them." Younger workers are more likely to want their companies to "take a public stand on an issue they care about." Nearly half of Gen Z workers also say they wouldn’t apply to "a company where the CEO supports a political candidate they disagree with," compared with about 30% of older-generation workers.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Maximizing your workplace benefits

Most employees spend 30 minutes or less reviewing their benefits during the open-enrollment period, said Alex Janin in The Wall Street Journal. "That’s a mistake, especially this year with costs for employer health coverage expected to jump" by about 6.5%. "The first mistake people make is assuming their health-care plan" will have the same coverage year-over-year, but a plan’s network of providers can shift. "Doctors aren’t required to tell patients in advance that they’re no longer accepting their insurance, so it’s a good idea to call them directly and ask." Elective benefits can also change and some newer additions like identity-theft protection, legal assistance, even pet insurance are growing popular — and usually they are “a better deal than you can get on the open market."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

Continue reading for free

We hope you're enjoying The Week's refreshingly open-minded journalism.

Subscribed to The Week? Register your account with the same email as your subscription.

Sign up to our 10 Things You Need to Know Today newsletter

A free daily digest of the biggest news stories of the day - and the best features from our website

-

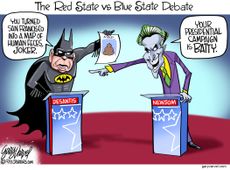

Today's political cartoons - December 2, 2023

Today's political cartoons - December 2, 2023Cartoons Saturday's cartoons - governors go Gotham, A.I. goes to the office party, and more

By The Week US Published

-

10 things you need to know today: December 2, 2023

10 things you need to know today: December 2, 2023Daily Briefing Death toll climbs in Gaza as airstrikes intensify, George Santos expelled from the House of Representatives, and more

By Justin Klawans, The Week US Published

-

5 hilarious cartoons about the George Santos expulsion vote

5 hilarious cartoons about the George Santos expulsion voteCartoons Artists take on Santa versus Santos, his X account, and more

By The Week US Published

-

Companies cut back on benefits

Companies cut back on benefitsFeature And more of the week's best financial insight

By The Week Staff Published

-

OpenAI: A boardroom coup wrenches the AI world

OpenAI: A boardroom coup wrenches the AI worldFeature OpenAI employees are asking the board to resign

By The Week US Published

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

By Harriet Marsden, The Week UK Published

-

Electric vehicles: Automakers fail to dent Tesla’s lead

Electric vehicles: Automakers fail to dent Tesla’s leadFeature The demand for EVs remains high, but sale numbers show a dip

By The Week US Published

-

Bank accounts caught up in red tape

Bank accounts caught up in red tapeFeature And more of the week's best financial insight

By The Week US Published

-

Self-service tills: the backlash begins

Self-service tills: the backlash beginsTalking Point Booths, the supermarket chain known as the 'Northern Waitrose', has decided to reintroduce humans to the checkout process

By The Week UK Published

-

Bankman-Fried: A con artist's day of reckoning

Bankman-Fried: A con artist's day of reckoningFeature How the crypto king's downfall might actually begin to restore trust in the crypto market

By The Week Staff Published

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

By Justin Klawans, The Week US Published