Bankman-Fried: A con artist's day of reckoning

How the crypto king's downfall might actually begin to restore trust in the crypto market

The smartest insight and analysis, from all perspectives, rounded up from around the web:

Sam Bankman-Fried tried to warn everyone, said David Streitfeld in The New York Times. As he "partied with stars and big shots," the onetime crypto king "always looked awkward, embarrassed and as if he would rather be playing a video game." He frequently conveyed "contempt for what he was doing," appealed for regulation and "seemed to implore the authorities to take a closer look at his companies," FTX and Alameda Research. Still, everyone kept insisting Bankman-Fried, or "SBF," was "off-the-charts brilliant, the entrepreneur who would create the future." Investors, customers and journalists "saw the genius they were told was there." In reality, as we know by now, FTX was "run by a group of hapless young people." Those who actually "sensed something was wrong soon peeled off," leaving a core crew led by Bankman-Fried, who will spend a long time in prison after being convicted last week of seven counts of fraud and conspiracy.

Bankman-Fried represents "the deceit fundamental to the crypto market itself," said Michael Hiltzik in the Los Angeles Times. He expertly "exploited the vacuity of crypto by slathering it over with what sounded like profundities." His marks had nothing to weigh them against, because "there is nothing real about crypto." What’s real is that FTX’s investors have lost as much as $10 billion and SBF is facing a prison term as long as 110 years. This won’t be the last crypto fraud, said Lionel Laurent in Bloomberg. In fact, the market already "is stirring again," and the price of Bitcoin, despite all the negative attention, is back above $35,000.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Bankman-Fried is exactly why crypto needs regulation, said Megan McArdle in The Washington Post. It’s an "ecosystem of people who think they’re far smarter than boring bankers or bank regulators." Bankman-Fried was "better at calculating odds" than most people, "but he still miscalculated a lot — including, on the odds that he might go to jail." Instead of pleading out, he "gambled on a trial" — then doubled down by "opening himself up to cross-examination." As soon "as the prosecutor confronted Bankman-Fried with evidence of his alleged guilt, it seemed obvious that he belongs in jail." Oddly, Bankman-Fried’s downfall might actually restore trust in crypto, said Anita Ramaswamy in Reuters. The swift conviction should be a wake-up call. It may even "cause a collective sigh of relief" from firms using digital currency technology "to solve real problems like streamlining cross-border payments and remittances."

This story isn’t really about crypto or arcane financial instruments, said Josie Cox in The Guardian. It’s about our urge to believe in the next big thing. Too many of us keep "stumbling into the trap of mythologizing shiny new technology and the people who push it," be that SBF or Theranos’ Elizabeth Holmes or WeWork’s Adam Neumann or Nikola’s Trevor Milton. This trial was a good counterweight: In the end, it was about "good old fashioned fraud and conspiracy." We’re looking "for an innovation that would actually change our ailing world," so we ignore all the clues that "things might actually be too good to be true."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

Continue reading for free

We hope you're enjoying The Week's refreshingly open-minded journalism.

Subscribed to The Week? Register your account with the same email as your subscription.

Sign up to our 10 Things You Need to Know Today newsletter

A free daily digest of the biggest news stories of the day - and the best features from our website

-

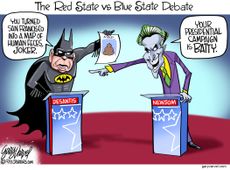

Today's political cartoons - December 2, 2023

Today's political cartoons - December 2, 2023Cartoons Saturday's cartoons - governors go Gotham, A.I. goes to the office party, and more

By The Week US Published

-

10 things you need to know today: December 2, 2023

10 things you need to know today: December 2, 2023Daily Briefing Death toll climbs in Gaza as airstrikes intensify, George Santos expelled from the House of Representatives, and more

By Justin Klawans, The Week US Published

-

5 hilarious cartoons about the George Santos expulsion vote

5 hilarious cartoons about the George Santos expulsion voteCartoons Artists take on Santa versus Santos, his X account, and more

By The Week US Published

-

Companies cut back on benefits

Companies cut back on benefitsFeature And more of the week's best financial insight

By The Week Staff Published

-

OpenAI: A boardroom coup wrenches the AI world

OpenAI: A boardroom coup wrenches the AI worldFeature OpenAI employees are asking the board to resign

By The Week US Published

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

By Harriet Marsden, The Week UK Published

-

Electric vehicles: Automakers fail to dent Tesla’s lead

Electric vehicles: Automakers fail to dent Tesla’s leadFeature The demand for EVs remains high, but sale numbers show a dip

By The Week US Published

-

Bank accounts caught up in red tape

Bank accounts caught up in red tapeFeature And more of the week's best financial insight

By The Week US Published

-

Self-service tills: the backlash begins

Self-service tills: the backlash beginsTalking Point Booths, the supermarket chain known as the 'Northern Waitrose', has decided to reintroduce humans to the checkout process

By The Week UK Published

-

Don’t count on working forever

Don’t count on working foreverFeature And more of the week's best financial insight

By The Week US Published

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

By Justin Klawans, The Week US Published