Ageing boomers: America’s looming crisis

A person turning 65 today in US has an almost 70% chance of needing long-term care

By 2034, the US will, for the first time in its history, have more residents over 65 than under 18, said Anna North on Vox.

Members of the vast baby boomer generation are entering a stage where they are liable to need assistance – and younger generations are not prepared for the consequences of this shift.

A lucky few older Americans will live independently until the end. But a person turning 65 today has an almost 70% chance of needing "long-term care".Who will provide it? Millennials are unlikely to have the job flexibility to become carers for their parents, especially if they have kids of their own. Paying for care is "ruinously expensive", and seniors only become eligible through Medicaid when they have "almost no assets left".

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

'Inter-generational fairness'

Many boomers needn't worry unduly, said Hillary Hoffower and Chloe Berger in Fortune. Relative to younger generations, they're very prosperous, thanks to government policies that have led to low interest rates (enabling them to lock into cheap mortgages) and boosted the value of real estate, among other assets. According to new figures, "US household net worth has skyrocketed from $17trn to $150trn" since the 1980s, and the older generations hold two-thirds of that pot.

Cries of inter-generational unfairness have been tempered by the idea that much of the $96trn held by the boomers will "trickle down" to younger generations via inheritance, giving "cash-strapped" millennials, Generation X-ers and Generation Z-ers a chance to catch up financially, said Ann C. Logue in Business Insider. But the Great Boomer Wealth Transfer may not come to pass. For one thing, that money is not spread equally: a lot of it is in the hands of very few families. Moreover, many boomers, having worked hard for years, are spending their cash on themselves, with only half an eye on providing for their kids. Since 1982, older households' consumer spending is up 34.5%, whereas it's up only 16.5% in younger generations. That may leave their children having to decide whether to care for their ageing parents themselves – or wait to see what is left of their potential inheritance once it's crushed by care costs.

'Rising numbers of sandwich generation'

The elder-care crisis is already troubling corporate America, said Matthew Boyle on Bloomberg. Some 37 million people are spending around four hours a day looking after older relatives; many are members of a "sandwich" generation, with children to look after too. This strain leads to lost working hours – and is a leading driver of employee turnover.

That is why some firms are now offering elder-care benefits through firms such as Wellthy. These aim to lift some of the burden of elder care by guiding people through tasks such as applying for state benefits, liaising with insurance companies, and negotiating with private care providers. Such benefits don't come cheap, but as the elder-care crisis intensifies, more and more CEOs may find they have to provide them if they want to retain their employees.

Continue reading for free

We hope you're enjoying The Week's refreshingly open-minded journalism.

Subscribed to The Week? Register your account with the same email as your subscription.

Sign up to our 10 Things You Need to Know Today newsletter

A free daily digest of the biggest news stories of the day - and the best features from our website

-

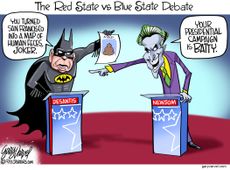

Today's political cartoons - December 2, 2023

Today's political cartoons - December 2, 2023Cartoons Saturday's cartoons - governors go Gotham, A.I. goes to the office party, and more

By The Week US Published

-

10 things you need to know today: December 2, 2023

10 things you need to know today: December 2, 2023Daily Briefing Death toll climbs in Gaza as airstrikes intensify, George Santos expelled from the House of Representatives, and more

By Justin Klawans, The Week US Published

-

5 hilarious cartoons about the George Santos expulsion vote

5 hilarious cartoons about the George Santos expulsion voteCartoons Artists take on Santa versus Santos, his X account, and more

By The Week US Published

-

Magic mushrooms and the mind

Magic mushrooms and the mindThe Explainer A growing number of states and cities are legalizing the use of psychedelic fungi in therapy. Some experts think that’s a big risk.

By The Week US Published

-

Why infant mortality is rising

Why infant mortality is risingThe Explainer The infant mortality rate recently rose for the first time in two decades

By Devika Rao, The Week US Published

-

The CDC has a new plan to address the health care worker burnout crisis

The CDC has a new plan to address the health care worker burnout crisisThe Explainer The program puts the pressure on health care leaders to lift some of the burdens of their employees

By Theara Coleman, The Week US Published

-

Anastrozole: the daily breast cancer pill tipped to save thousands of lives

Anastrozole: the daily breast cancer pill tipped to save thousands of livesThe Explainer Existing treatment approved for preventative use under 'pioneering' NHS drug repurposing scheme

By Harriet Marsden, The Week UK Published

-

The fight against malaria

The fight against malariaThe Explainer After declining for decades, deaths from the disease are suddenly on the rise. What’s changed?

By The Week US Published

-

The pros and cons of safe injection sites for opioids

The pros and cons of safe injection sites for opioidsPros and cons The sites have saved lives but many worry they're too lax

By Devika Rao, The Week US Published

-

America’s opioid epidemic

America’s opioid epidemicThe Explainer For the past 20 years, the US has been battling a devastating public health crisis caused by powerful painkillers

By The Week UK Published

-

Babylon Health: the failed AI wonder app that 'dazzled' politicians

Babylon Health: the failed AI wonder app that 'dazzled' politiciansThe Explainer Demise of UK tech start-up is a cautionary tale for politicians seeking quick fixes to complicated problems

By The Week UK Last updated